Loading

Get Form Of Return Of Income Under The Income-tax ... - Nbr Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

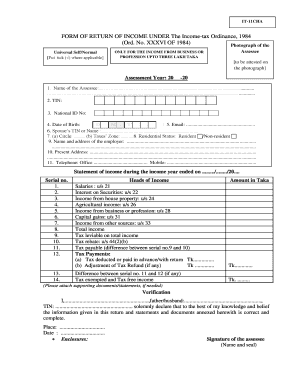

How to fill out the FORM OF RETURN OF INCOME UNDER The Income-tax Ordinance online

Filing your income tax return is an important obligation for individuals in compliance with the Income-tax Ordinance. This guide serves as a comprehensive resource for understanding how to properly complete the FORM OF RETURN OF INCOME, ensuring that all necessary information is provided accurately.

Follow the steps to fill out the FORM OF RETURN OF INCOME accurately.

- Click the ‘Get Form’ button to access the FORM OF RETURN OF INCOME. This will allow you to obtain the document and prepare for completion.

- Begin filling out the form by entering your name as the assessee in the designated field. Ensure that the name matches the information on your identification documents.

- Provide your Tax Identification Number (TIN) in the next section. This unique identifier is crucial for proper processing of your return.

- Enter your National ID Number in the following field, ensuring that it is accurate and reflects your legal identification.

- Input your date of birth. Use the format provided, ensuring it is legible and correct.

- Fill in your email address. This is necessary for any future correspondence regarding your return.

- If applicable, enter your spouse’s TIN or name. Ensure that this section reflects accurate and truthful information.

- Circle the appropriate option for your residential status, indicating whether you are a resident or non-resident.

- In the next section, provide the name and address of your employer. This helps in confirming your employment details.

- Enter your current residential address, making sure it is complete and accurate.

- Provide your office and mobile telephone numbers. This information may be required for follow-up.

- Complete the statement of income by listing all sources of income under the mentioned heads, such as salaries, interest on securities, agricultural income, etc. Fill in the amounts accurately.

- Calculate and input the total income based on the entries from the previous step.

- Determine the tax leviable on your total income and write this amount in the specified field.

- Include any tax rebates applicable to you in the designated area.

- Calculate the tax payable by subtracting the tax rebate from the total tax.

- Record any advance tax payments or deductions in the tax payments section.

- In the verification section, solemnly declare that the information provided is correct by signing and dating the form. Attach any necessary documents to support your statements.

- Once you have filled in all required information and verified its accuracy, proceed to save your changes. You may also download, print or share the completed form as needed.

Complete your income tax forms online today for efficient processing!

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.