Loading

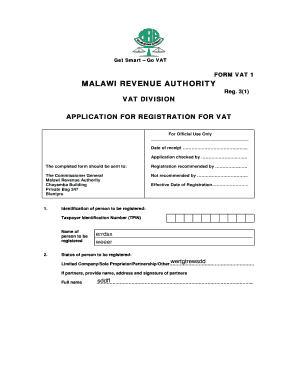

Get Vat Registration Application Form - Malawi Revenue Authority

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT Registration Application Form - Malawi Revenue Authority online

This guide provides clear and comprehensive instructions on how to fill out the VAT Registration Application Form required by the Malawi Revenue Authority. Following these steps will ensure that your application is completed correctly and efficiently.

Follow the steps to complete your VAT registration application form online.

- Use the ‘Get Form’ button to obtain the VAT Registration Application Form and open it in your chosen editor.

- Begin by entering the effective date of registration in the designated field.

- Provide the Taxpayer Identification Number (TPIN) of the person or entity to be registered.

- Fill in the name of the person or entity being registered.

- Indicate the status of the person or entity to be registered, such as Limited Company, Sole Proprietor, Partnership, or Other. If applicable, list the names, addresses, and signatures of the partners.

- Input the full address of the principal place of business.

- Specify the location of the main premises.

- Describe the nature of the business being conducted.

- If applicable, enter the trading name of the business.

- Complete the section for the name of the person making the application, including their surname and other names.

- Select the status of the person making the application, whether they are a Proprietor, Company Secretary, Partner, Director, or Authorised Officer.

- Provide the telephone number and email address of the applicant.

- Report the annual turnover of taxable supplies in both actual figures for the past twelve months and expected figures for the next twelve months, including relevant details if turnover is less than K2,000,000.

- List the expected annual turnover of exempt supplies for the next twelve months.

- State the current value of stock, including purchases and expenses.

- If applicable, provide information about any associated business, including their TPIN and other details.

- In the declaration section, the signatory must print their full name and confirm the truthfulness of the information provided. This section must be signed and dated.

- Once all fields are completed, save your changes, download the form, and choose to print or share as needed.

Complete your VAT Registration Application Form online to ensure your business is compliant and registered.

ActualPreviousHighest16.5016.5016.50

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.