Loading

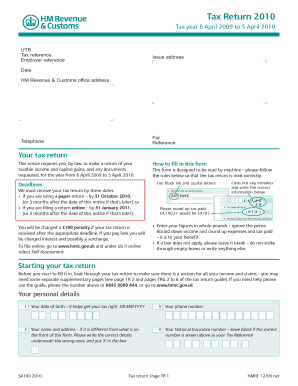

Get Tax Return. Use Form Sa100 To File A Tax Return For Your Income And Capital Gains And To Claim Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Tax Return. Use Form SA100 To File A Tax Return For Your Income And Capital Gains And To Claim Tax online

Filing your tax return is an essential responsibility for individuals earning an income or generating capital gains. This guide provides step-by-step instructions on how to fill out the Tax Return using Form SA100, ensuring that you can complete your return accurately and efficiently.

Follow the steps to fill out your tax return correctly.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Carefully review the tax return to ensure you have all the necessary sections for your income and claims. You may need separate supplementary pages if required.

- Fill in your personal details accurately including your name, address, date of birth, and National Insurance number.

- Respond to the questions regarding different income sources, indicating 'Yes' or 'No' as applicable. Check if supplementary pages are needed based on your responses.

- For each source of income, provide the required figures in whole pounds. Round up expenses and taxes paid for optimal reporting.

- Complete the section for tax reliefs, including any contributions to pension schemes and charitable donations.

- Evaluate whether you have overpaid or underpaid taxes to determine how to proceed with any repayments or additional payments that may be necessary.

- Sign and date the form, confirming that your information is complete and accurate to the best of your knowledge.

Don't wait, complete your tax return online today!

The SA108 form is a document you need to fill and submit to HMRC if you have to pay tax on your capital gains.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.