Loading

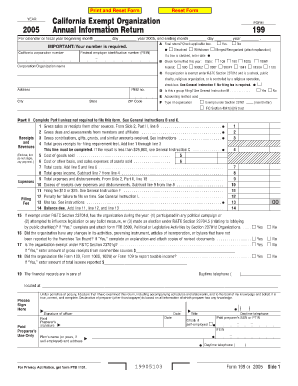

Get Form 199 2005 California Exempt Organization Annual ... - Ftb.ca.gov - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 199 2005 California Exempt Organization Annual return online

Filing the Form 199 is essential for California exempt organizations to report their annual information. This guide provides a clear, step-by-step approach to ensure that users can complete the form accurately and efficiently.

Follow the steps to fill out the Form 199 correctly

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the year for which you are reporting. Enter the calendar or fiscal year beginning and ending dates in the designated fields.

- Provide your California corporation number and indicate if your organization is dissolved, withdrawn, or merged. If applicable, enter the date these actions occurred.

- Check the forms you have filed for the year, including any state and federal forms that apply to your organization.

- Complete the question regarding whether this is a final return and provide your Federal Employer Identification Number (FEIN).

- Enter your organization's name and address details accurately, including any relevant information such as a PMB number.

- Indicate if this is a group filing, and supply the accounting method used by your organization.

- In Part I, report gross sales or receipts from other sources, dues and assessments, and contributions. Add these together to complete the total gross receipts.

- Input your organization's expenses and disbursements, and ensure to calculate the total for these items.

- Fill out any necessary information for specific questions regarding political activity, changes in governing documents, or other obligations.

- Once all sections are completed, you can save your changes, download, print, or share the Form for submission.

Complete your Form 199 online today to ensure your organization remains compliant with California tax regulations.

Related links form

B. Who Must File Normal gross receiptsFileGross receipts normally $50,000 or less*FTB 199NGross receipts more than $50,000Form 199Private foundations (regardless of gross receipts)Form 199Nonexempt charitable trusts described in IRC Section 4947(a)(1) (regardless of gross receipts)Form 199

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.