Loading

Get Record Keeping Agreement - Azdot

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Record Keeping Agreement - Azdot online

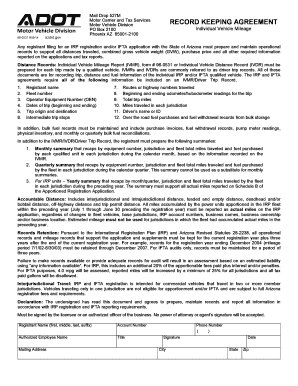

This guide provides clear, step-by-step instructions on how to accurately complete the Record Keeping Agreement - Azdot form online. By following these guidelines, users can ensure that they fulfill the necessary operational record-keeping requirements for IRP and IFTA registrations in Arizona.

Follow the steps to complete the Record Keeping Agreement - Azdot online

- Click ‘Get Form’ button to obtain the Record Keeping Agreement - Azdot and open it in your preferred document editor.

- Begin by filling out the registrant name, ensuring you enter your complete name as it appears on official documents.

- Next, enter your fleet number, which is critical for identifying your specific vehicle fleet within the system.

- Provide the operator equipment number (OEN) for each vehicle in your fleet. This helps in tracking vehicle operations.

- Record the dates of the trip, including both the start and end dates, to maintain accurate operational timelines.

- Indicate the trip's origin and destination, which are necessary for assessing distance records.

- List any intermediate trip stops to ensure a complete record of the route taken.

- Document the routes or highway numbers traveled during the trip for clarity in distance reporting.

- Fill in the beginning and ending odometer or hubodometer readings, as these will help calculate total distance traveled.

- Calculate the total trip miles and input this information in the designated field.

- Include miles traveled in each jurisdiction, which is essential for properly reporting to regulatory bodies.

- Enter the driver's name or ID associated with the trip, ensuring proper attribution for accountability.

- Provide details of over-the-road fuel purchases and fuel withdrawal records from bulk storage, as these are also required records.

- Conclude by providing a signature of the registrant or authorized representative, along with the date, to certify the accuracy of the provided information.

Start completing your Record Keeping Agreement - Azdot online today!

Is IFTA required? Yes, federal law requires that commercial truck companies abide by IFTA regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.