Loading

Get Individual Foreign Tax Residency Self-certification Form - Ing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Foreign Tax Residency Self-certification Form - ING online

This guide provides step-by-step instructions for completing the Individual Foreign Tax Residency Self-certification Form - ING online. Accurate completion of this form is essential for individuals to ensure compliance with foreign tax residency requirements.

Follow the steps to complete your online form successfully.

- Press the ‘Get Form’ button to access the Individual Foreign Tax Residency Self-certification Form - ING in your browser.

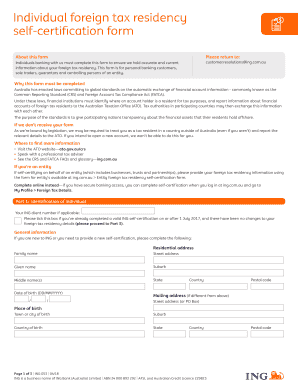

- Begin with Part 1: Identification of individual. Enter your ING client number, if applicable. If you have completed a valid ING self-certification since July 1, 2017, and your tax residency has not changed, tick the designated box and proceed to Part 3.

- If you are new to ING or need to provide a new self-certification, fill in your residential address, including your family name, given name, middle name(s), and date of birth in the specified format (DD/MM/YYYY).

- Complete your place of birth information, including the town or city, country of birth, and other related details.

- In the source of wealth and funds section, select one item from each column based on your primary source.

- Indicate whether you are a U.S. Person for tax purposes and if Australia is your sole country of tax residence by selecting 'Yes' or 'No'.

- Move to Part 2: Country of foreign tax residence and related Taxpayer Identification Number. Fill in the table, listing each country of tax residency (other than Australia) and corresponding TIN or equivalent.

- Proceed to Part 3: Declarations. Read through the statements, affirm the accuracy of your information, and provide your full name, signature, and date.

- If you are signing on behalf of another individual, specify your capacity, and attach any necessary supporting information.

- Finally, after completing the form, ensure to save any changes, then download, print, or share the form as needed.

Complete your Individual Foreign Tax Residency Self-certification Form - ING online today for accurate tax residency management.

Related links form

This process is called “self-certification” and we are required to collect this information under the CRS. Is everyone doing this? All financial institutions – that includes banks, insurers and asset management businesses – in participating countries (including Australia) are required to be compliant with the CRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.