Loading

Get Business Owners Section - Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BUSINESS OWNERS SECTION - Forms online

Filling out the business owners section of forms online can be straightforward with the right guidance. This comprehensive guide will provide clear instructions to help you complete this section accurately and efficiently.

Follow the steps to fill out the business owners section of the forms online.

- Use the ‘Get Form’ button to access the business owners section and open it in your editor.

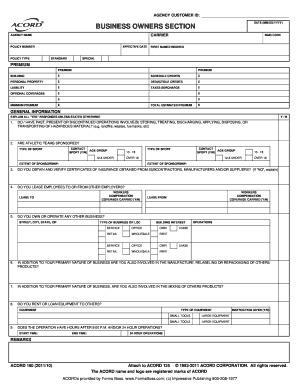

- Begin by filling in the agency customer ID and the date in the specified format (MM/DD/YYYY). This information is essential for identifying your application.

- Complete the carrier and agency name fields with the correct information to ensure the proper handling of your application.

- Enter the policy number and type, ensuring that these details match your existing documentation.

- Specify the effective date of the policy. This indicates when your coverage will begin.

- In the business owners section, input the first named insured's name accurately, as it represents the primary policyholder.

- Continue by filling out the premium amounts in the appropriate fields, including building, personal property, liability, and any additional coverages.

- Respond to the general information section by indicating 'yes' or 'no' for each question, and provide explanations for any 'yes' answers as instructed.

- Ensure you review all entered information for accuracy before finalizing your application.

- Once all fields are completed and reviewed, you can save your changes, download, print, or share the form as needed.

Start filling out your business owners section online today for a seamless experience.

Form 1065 is for partnerships, and Form 1120-S is for S corporations, but both serve the same purpose. The partnership or S-corp must file this form to report each partner or shareholder's share of the entity's income, deductions, and credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.