Loading

Get It05 Form Jamaica

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It05 Form Jamaica online

Filling out the It05 Form Jamaica can seem daunting, but with clear instructions, the process can be smooth and efficient. This guide will walk you through each section of the form, ensuring you have all the necessary information at your fingertips.

Follow the steps to successfully complete the It05 Form Jamaica online.

- Click ‘Get Form’ button to obtain the form and access it for completion.

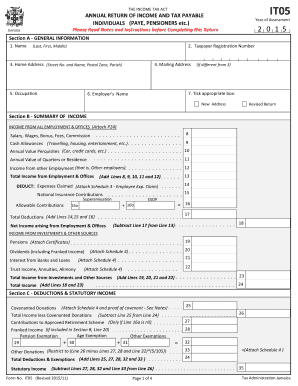

- Begin by filling out Section A – General Information. Provide your full name as it appears on legal documents, your taxpayer registration number, and your home address, including street number, name, postal zone, and parish. If your mailing address differs from your home address, be sure to fill that in as well.

- In Section B – Summary of Income, record your income from all employment and other sources. Utilize any available documentation, such as P24 forms, to accurately input your salary, bonus, commissions, and any allowances. Ensure all amounts are rounded to the nearest whole number.

- Continue to Section C – Deductions & Statutory Income. Here, you will list any allowed deductions such as covenanted donations and expenses claimed. Be mindful to attach any required supporting schedules.

- In Section D – Tax Computation, calculate your income tax payable based on the figures you've provided. Make sure to include all relevant tax credits and calculations for dividends if applicable.

- Finally, complete Section E – Declaration. Sign and date the form to confirm the accuracy of your information. Remember that submitting false information may result in penalties.

- Once you have filled out the form completely, save your changes and choose to download, print, or share the completed form as necessary.

Start filling out your IT05 form online today and ensure your tax return is submitted accurately and on time.

In general, Jamaican residents and domiciled individuals are taxed on their worldwide income, while non-resident individuals are taxed on Jamaican-sourced income. A non-Jamaican domiciled individual is generally not taxable on foreign-sourced income unless one remits this to Jamaica.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.