Loading

Get Loan Enquiry Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Enquiry Form online

Filling out the Loan Enquiry Form online can seem daunting, but with clear instructions, it can be a straightforward process. This guide will walk you through each section of the form to ensure a complete and accurate submission.

Follow the steps to successfully complete the Loan Enquiry Form.

- Press the ‘Get Form’ button to access the Loan Enquiry Form and open it in the editor.

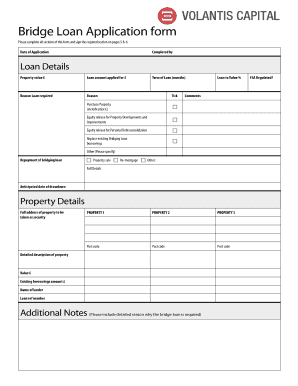

- Begin by entering the 'Date of Application' at the top of the form. This information helps track your application timeline.

- In the 'Completed by' section, provide your name or the name of the individual completing the form.

- Fill in the 'Loan Details', including the 'Property value', 'Loan amount applied for', 'Term of Loan', and 'Reason Loan required'. Select the appropriate reason by checking the corresponding box.

- Provide details regarding the anticipated date of drawdown and any comments about the loan's purpose in the 'Additional Notes' section.

- In the 'Property Details' section, enter the full address and relevant details for up to three properties. Include the property value and existing borrowings information.

- Complete the 'Personal Details' section for each applicant, providing names, contact information, and financial details as prompted.

- If multiple applicants are involved, ensure that all requested information is clearly filled out for all individuals.

- After filling out the form, review all details to confirm their accuracy. Save any changes made during the filling process to ensure none are lost.

- Finally, download, print, or share the completed Loan Enquiry Form as needed before sending it to the appropriate address.

Begin the process by filling out the Loan Enquiry Form online for a smooth application experience.

While a few credit enquiries may have absolutely no effect on your credit score, multiple checks over a six month period can leave a noticeable mark. The damage done to your credit score usually disappears over time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.