Get Wells Fargo Financial Work Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wells Fargo Financial Work Sheet online

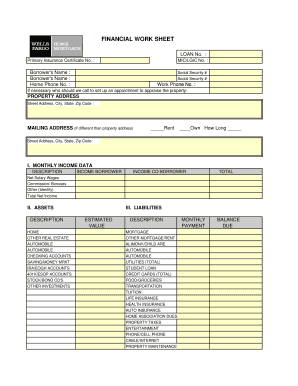

The Wells Fargo Financial Work Sheet is an essential document that helps users provide a comprehensive overview of their financial situation. This guide will walk you through the process of filling out the form online, ensuring you accurately report your information.

Follow the steps to complete the financial work sheet with confidence.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your loan number and primary insurance certificate number in the designated fields. Ensure these numbers are accurate to avoid any confusion during processing.

- Next, fill out the borrower's name and contact information, including home phone and work phone numbers. If applicable, provide a social security number for both the borrower and co-borrower.

- Provide the property address where the loan will be applied. If the mailing address is different from the property address, complete the mailing address section as well.

- In the monthly income data section, list all income sources for both the borrower and co-borrower. Specify amounts for net salary, wages, commissions, bonuses, and any other identified sources.

- Proceed to the assets section. Here, list all relevant assets, being as specific as possible to provide a clear financial picture.

- In the liabilities section, detail any outstanding balances, including monthly payments and total amounts due for items like mortgages, auto loans, credit cards, and other financial obligations.

- Briefly explain any financial hardship that may affect repayment. Be clear and honest to provide a transparent account of your situation.

- Review the certification statement carefully. Ensure that all information provided is true and accurate before signing and dating the document.

- Make note of the final instructions, which include signing the form, attaching your last year's federal tax return, and including your most recent pay stubs or proof of income if self-employed. Finally, save your changes, and proceed to download, print, or share your completed form.

Complete your Wells Fargo Financial Work Sheet online today and take the next step toward managing your financial future.

Tracking your spending is simple with Wells Fargo's online banking tools. You can use their spending summary to get an overview of your expenses. Additionally, maintaining a Wells Fargo Financial Work Sheet can provide you with a detailed breakdown of your spending patterns, helping you stay on top of your finances.

Fill Wells Fargo Financial Work Sheet

Groceries: List the average amount spent monthly on groceries, toiletries, and paper products. Housing. Current. At retirement. Step 1: Organize your financial documents. At its core, a budget is a worksheet with separate categories for income, expenses, and savings. This article will explore the purpose of the financial worksheet, its components, and how to effectively utilize it to achieve your homeownership goals. Log in for more information. The first step in creating a budget is identifying all of your income sources and deciding if you want to track your budget weekly, monthly, or quarterly. Annual Discretionary. Expense Amount. Housing. Download or share this interactive workbook packed with financial information and guidance to help navigate the college planning process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.