Loading

Get Delaware Claim For Revision Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware Claim For Revision Form online

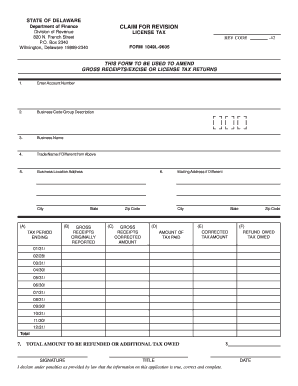

This guide provides detailed instructions on how to complete the Delaware Claim For Revision Form online. Whether you are amending gross receipts, excise, or license tax returns, this comprehensive resource will support you in filling out the necessary fields correctly.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your account number in the designated field. You can find this number on your coupon booklet.

- Provide the Business Code Group Description corresponding to your business from your coupons.

- Enter your business name, or if you are a sole proprietor, your individual name in the appropriate section.

- If your trade name differs from your business name, fill in that information as well.

- Include the complete location address of your business, ensuring you provide the street, city, state, and nine-digit zip code.

- If your mailing address is different from your business location, enter that address in the mailing address section.

- In Column A, indicate the tax period ending. If you are amending multiple tax periods in the same calendar year, make sure you complete a separate revision form for each year.

- Column B requires you to input the gross receipts originally reported for each tax period, broken down by each month, even if filed quarterly.

- In Column C, enter the corrected amount of gross receipts for each corresponding month.

- Column D should contain the amount of tax originally paid for each tax period.

- Recalculate the correct tax amount owed for each period and enter this figure in Column E.

- In Column F, input the difference between the originally paid tax and the corrected tax. If this amount reflects additional tax owed, enclose it in brackets.

- Finally, total the amounts in Columns B, C, D, and E. Record this total in Line 7.

- After reviewing your entries for accuracy, save your changes, download, print, or share the completed form as needed.

Take the next step towards filing your documents online today.

Your Delaware extension request must be filed by the original deadline of your return. Delaware Tax Extension Tips: If you have a 6-month Federal tax extension (IRS Form 7004), the State of Delaware will automatically grant you a 6-month Delaware extension.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.