Get Tsp-3 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-3 online

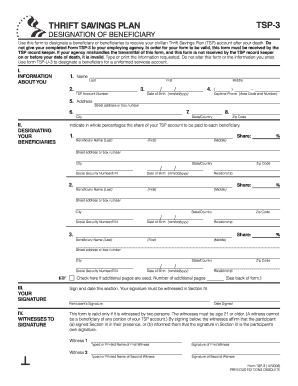

The TSP-3 form is essential for designating beneficiaries for your Thrift Savings Plan account after your death. Completing this form accurately ensures that your assets are distributed according to your wishes. This guide provides step-by-step instructions to assist you in filling out the TSP-3 online.

Follow the steps to accurately designate your beneficiaries.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in Section I. This includes your full name (last, first, middle), TSP account number, date of birth, street address, city, state/country, zip code, and daytime phone number.

- Proceed to Section II to designate your beneficiaries. For each beneficiary, you need to provide their full name, share of the TSP account (in whole percentages that total 100%), address, Social Security number or Employer Identification Number, date of birth, and relationship to you.

- If you wish to designate contingent beneficiaries, indicate this with 'If living:' above their names. Ensure that the designated shares still add up to a total of 100 percent.

- In Section III, sign and date the form. Remember, your signature must be witnessed in Section IV.

- Section IV requires two witnesses who are age 21 or older and are not beneficiaries. Have them print their names and sign next to your signature.

- If you are using additional pages, check the box indicating so and enter the number of pages used. Ensure each page includes your name, TSP account number, and date of birth, and is signed by both you and the witnesses.

- Finally, review all entered information for accuracy. Once everything is correct, save the form, and ensure you mail or fax the original to the address provided in the form’s instructions.

Complete your TSP-3 form online now to ensure your beneficiaries are properly designated.

Get form

To report your TSP on your taxes, you will need to include any withdrawals, distributions, or contributions on your tax return. Forms such as the 1099-R and your annual TSP statement will provide you with necessary details for accurate reporting. If you're unsure of the tax implications related to your TSP, consulting a tax professional can help clarify the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.