Loading

Get Trust Transfer Deed Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Transfer Deed Sample online

Filling out a Trust Transfer Deed is an essential process for transferring property under a trust. This guide provides a step-by-step approach to completing the Trust Transfer Deed Sample online with clarity and confidence.

Follow the steps to complete the Trust Transfer Deed Sample

- Click the ‘Get Form’ button to access the document and open it in an online editor.

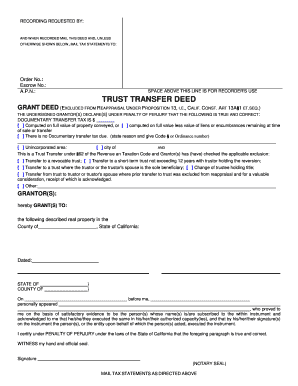

- In the first section, fill in the 'Recording Requested By' line with the name of the person or entity requesting the deed. Additionally, complete the 'When Recorded Mail This Deed To' section, providing the address where the deed should be sent.

- Enter the order number, escrow number, and Assessor's Parcel Number (A.P.N.) in the designated fields. This information is vital for the recording process.

- Complete the statement regarding the documentary transfer tax. Indicate either the computed amount based on full property value or select the appropriate reason if there is no tax due.

- Select the applicable exclusion options under §62 of the Revenue and Taxation Code. Check the boxes corresponding to the type of trust transfer being made.

- Identify the grantor(s) by entering their names in the 'Grantor(s)' section. This identifies the individual(s) transferring the property.

- Specify the grantee to whom the property is being transferred by filling in the 'Grant(s) To' section, including a detailed description of the real property.

- Provide the date of the document signing in the specified area. This date is essential for recording purposes.

- In the acknowledgment section, the signer will complete the necessary notary section, including personal identification. Ensure that all required signatures are obtained.

- Once all sections are completed, review the information for accuracy. You can then save changes, download, print, or share the Trust Transfer Deed as needed.

Begin filling out your Trust Transfer Deed Sample online today and ensure your property transfer is processed smoothly.

A New Deed When the affidavit is filed and recorded with the county recorder, the successor trustee can sell the property or transfer ownership to the decedent's children. If the property is going to be kept by the family, a new deed transferring ownership to the beneficiaries named in the trust is necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.