Loading

Get Post Summary Adjustment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Post Summary Adjustment online

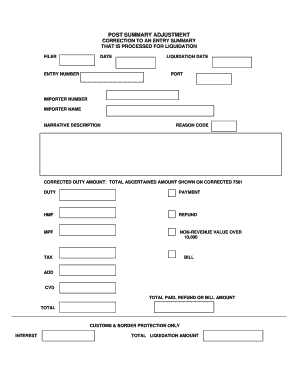

The Post Summary Adjustment form is essential for correcting entries processed for liquidation. This guide will provide clear, step-by-step instructions to assist users in completing the form online, ensuring accuracy and compliance.

Follow the steps to successfully complete the Post Summary Adjustment form.

- Press the ‘Get Form’ button to access the Post Summary Adjustment form and open it in your preferred online editor.

- Fill in the 'Filer' section with your information. Enter your name or the name of the organization submitting the form.

- In the 'Date' field, enter the date when you are completing the form.

- Provide the 'Entry Number' associated with the entry you are adjusting. This is crucial for tracking your submission.

- Input the 'Liquidation Date', which refers to the date your entry was liquidated.

- Fill out the 'Port' field by specifying the port through which the goods were imported.

- Enter the 'Importer Number' and 'Importer Name' to identify the party responsible for the import.

- In the 'Narrative Description' section, provide a clear explanation of the reason for your adjustment. Be concise but thorough.

- Choose the appropriate 'Reason Code' from the list of codes provided. This will classify the reason for the post summary adjustment.

- Under 'Corrected Duty Amount', enter the total duty amount as shown on the corrected CBP Form 7501.

- Specify any applicable amounts for 'Payment', 'HMF', 'Refund', 'MPF', 'Tax', and 'Bill'. Ensure you include values over 10,000 as necessary.

- Indicate the total amount for customs services, following the guidance for 'Total Paid, Refund or Bill Amount'.

- For 'Interest', provide the relevant amount as instructed.

- Calculate and print the 'Total Liquidation Amount', which summarizes all entries on the form.

- Review all entered information for accuracy. Once you are satisfied, save your changes. You may also download, print, or share the completed form as needed.

Complete your Post Summary Adjustment form online today for fast and accurate processing.

A post entry amendment allows you to correct information on an already filed customs entry, similar to a post summary correction but with different rules. This process ensures that any new information affecting duties or compliance is accurately reflected. Utilizing tools like uslegalforms can facilitate the amendment process, making it less daunting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.