Loading

Get Instructions For Transportation Mileage Log

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Transportation Mileage Log online

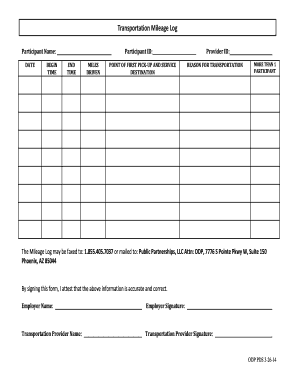

Completing the Instructions For Transportation Mileage Log is essential for accurately documenting transportation mileage under the VF/EA participant direction model. This guide provides a clear, step-by-step process to assist you in filling out the form correctly and efficiently.

Follow the steps to complete your Transportation Mileage Log online.

- Press the ‘Get Form’ button to access the Transportation Mileage Log and open it for editing.

- Fill in the Participant’s Name, Participant’s ID (C#), and the Provider’s ID (E#) in the designated fields.

- For each round trip provided, complete one row in the log. A round trip is the distance from the first pick-up point to the service destination and back to the origin.

- In each row, enter the Date, Begin Time, End Time, Miles Driven, Point of First Pick-up, Service Destination, Reason for Transportation, and indicate if transportation was provided to More than 1 Participant.

- At the bottom of the form, ensure that both the Common Law Employer and the Transportation Provider sign and date the Transportation Mileage Log.

- Once all sections are completed, submit the Transportation Mileage Log alongside the Request for Vendor Payment form to Public Partnerships, LLC.

- You may fax the completed Mileage Log to 1.855.405.7037 or mail it to Public Partnerships, LLC, Attention: ODP, 7776 S Pointe Pkwy W, Suite 150, Phoenix, AZ 85044.

- After submission, you can save the changes, download, print, or share the form as needed.

Complete your Transportation Mileage Log online today to ensure accurate documentation and prompt processing.

Follow the steps below on how to log mileage for taxes. Ensure you qualify for mileage deduction. ... Choose your calculation method. ... Ensure your odometer records the reading at the start of the tax year. ... Maintain the driving log if necessary. ... Keep records of the receipts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.