Loading

Get Jackson Hewitt Client Data Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Jackson Hewitt Client Data Sheet online

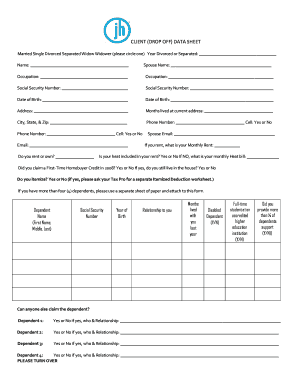

The Jackson Hewitt Client Data Sheet is essential for gathering personal and financial information necessary for tax preparation. By following this guide, users can ensure they complete the form accurately and efficiently online.

Follow the steps to successfully complete your Client Data Sheet.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

- Begin filling out your personal information. Indicate your marital status by circling 'Married,' 'Single,' 'Divorced,' 'Separated,' 'Widow,' or 'Widower.' Provide the year you were divorced or separated if applicable.

- Input your name and, if applicable, your spouse's name in the designated fields.

- Complete the occupation sections for both yourself and your spouse, ensuring accuracy.

- Enter the Social Security Numbers for both yourself and your spouse in the correct fields.

- Provide your date of birth and your spouse's date of birth in the corresponding sections.

- Fill in your current address, including the number of months you have lived there.

- List your city, state, and zip code, ensuring the information is current.

- Input your phone number and indicate whether it is a cell phone. Repeat for your spouse's phone number.

- Provide your email address and, if applicable, your spouse's email.

- Indicate whether you rent or own your home. If you rent, note your monthly rent and whether heat is included in your rent. If heat is not included, state your monthly heat bill.

- Answer whether you claimed a First-Time Homebuyer Credit in 2008 and if you still reside in the house.

- Indicate whether you itemize your deductions. If you do, consult your tax professional for an Itemized Deduction worksheet.

- If you have more than four dependents, please attach a separate sheet listing their information.

- For each dependent, provide the required details, including name, Social Security number, year of birth, relationship to you, duration lived with you last year, and whether they are disabled, a full-time student, or can be claimed by someone else.

- For any adopted children last year, indicate whether you adopted a child and how much you paid in adoption expenses.

- List daycare provider information for each provider as required, and document details about the services provided.

- Check the boxes next to your sources of income and provide amounts where applicable.

- Complete the healthcare section by providing information about your health insurance coverage for the tax year.

- Fill in the adjustments to income section, including any IRA contributions, student loan interest, and other relevant financial data.

- Sign and date the Client Data Sheet, ensuring both you and your spouse sign if applicable.

- Once finished, save changes, and download, print, or share the form as needed.

Start filling out your Jackson Hewitt Client Data Sheet online now to ensure a smooth tax preparation process.

An Access code will be emailed to your registered email address. The email will come from webmaster@jacksonhewitt.com.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.