Loading

Get Loan Abstract

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Abstract online

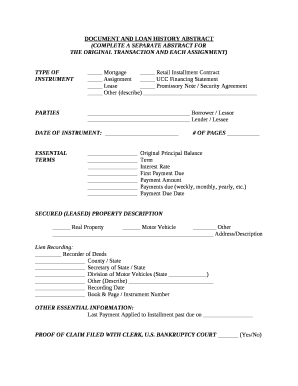

The Loan Abstract is a comprehensive document used to summarize essential information regarding a financial transaction involving loans. This guide will provide clear instructions on completing the Loan Abstract online, ensuring users can easily submit accurate information.

Follow the steps to complete the Loan Abstract online.

- Press ‘Get Form’ button to access the form and open it for editing.

- Identify the type of instrument being abstracted by checking the appropriate option, such as mortgage, retail installment contract, or other.

- In the 'Parties' section, enter the names of the borrower or lessor, as well as the lender or lessee.

- Fill in the 'Date of Instrument' field with the date the transaction was executed.

- In the 'Essential Terms' section, include relevant terms like the original principal balance, term, interest rate, first payment due date, payment amount, and the payment frequency.

- For 'Secured (Leased) Property Description,' indicate whether the property is real property, motor vehicle, or other and provide the corresponding address or description.

- Complete the 'Lien Recording' section by including the recorder of deeds, county/state, any applicable secretary of state, division of motor vehicle information, and the recording date.

- Add any additional essential information, including the last payment applied to installment past due date and if proof of claim has been filed with the clerk, U.S. Bankruptcy Court.

- Review all entered information for accuracy. After ensuring all fields are complete and accurate, save changes, and choose to download, print, or share the completed form.

Complete your Loan Abstract online today to ensure a smooth processing of your documentation.

Loan documents are documents provided and requested by lenders for the purpose of providing a loan. They are typically statements of personal and financial information of the borrower to approve a loan. These documents are used by the lenders to evaluate whether or not they will provide you with a loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.