Get Initial Escrow Account Disclosure Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Initial Escrow Account Disclosure Statement online

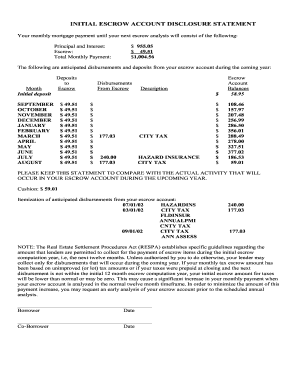

The Initial Escrow Account Disclosure Statement provides essential information regarding your mortgage payment and the related escrow account activity. Understanding how to accurately complete this document online is key to properly managing your escrow funds and ensuring compliance with relevant regulations.

Follow the steps to complete your Initial Escrow Account Disclosure Statement.

- Press the ‘Get Form’ button to access the Initial Escrow Account Disclosure Statement in the online editor.

- Begin by entering your monthly mortgage payment details. Include the amounts for Principal and Interest, Escrow, and the Total Monthly Payment.

- For each month of the year, provide the initial deposit followed by any anticipated deposits to the escrow account as indicated. Make sure to review the amounts for accuracy.

- Document all disbursements from the escrow account for the upcoming year. Include the relevant amounts for each specified month and ensure calculations are correctly represented.

- Detail the escrow account balances for each month, confirming that the figures align with your expected disbursements. Double-check for any discrepancies and rectify them in the form.

- Add a description of anticipated disbursements, ensuring you reference specifics such as city tax, hazard insurance, or any other relevant expenses that will be paid through the escrow.

- Review the cushion amount listed to ensure that it complies with the expected disbursements from your escrow account. Look for accuracy and confirm that it meets required guidelines.

- Once all sections are filled out accurately, save your changes. You may also choose to download, print, or share the completed form as necessary.

Complete your escrow account documentation online today to ensure accurate management of your mortgage payments.

Related links form

The initial escrow account disclosure statement is an essential document that outlines your estimated escrow payment amounts and the purposes of those payments. This statement provides clarity on how your funds will be allocated throughout the year. With this information, you gain a better understanding of your financial commitments as a homeowner.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.