Get Indian Head Casino W-2g/win-loss Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign Indian Head Casino W-2G/Win-Loss Request Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Commercial, legal, fiscal, and various electronic documents necessitate a greater level of safeguarding and adherence to regulations. Our documents are refreshed consistently in line with the most recent changes in legislation.

Furthermore, all the information you provide in your Indian Head Casino W-2G/Win-Loss Request Form is secured against loss or harm through advanced encryption.

Our service enables you to manage the entire process of executing legal documents online. As a result, you save hours (if not days or even weeks) and eliminate unnecessary costs. From now on, complete the Indian Head Casino W-2G/Win-Loss Request Form from your home, workplace, or even while on the move.

- Access the form in the comprehensive online editor by clicking Get form.

- Complete the mandatory fields highlighted in yellow.

- Click the arrow labeled Next to transition from one field to another.

- Navigate to the electronic signature tool to e-sign the document.

- Enter the pertinent date.

- Review the entire document to ensure you haven’t overlooked anything.

- Click Done and save the finished document.

Tips on how to fill out, edit and sign Indian Head Casino W-2G/Win-Loss Request Form online

How to fill out and sign Indian Head Casino W-2G/Win-Loss Request Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Commercial, legal, fiscal, and various electronic documents necessitate a greater level of safeguarding and adherence to regulations. Our documents are refreshed consistently in line with the most recent changes in legislation.

Furthermore, all the information you provide in your Indian Head Casino W-2G/Win-Loss Request Form is secured against loss or harm through advanced encryption.

Our service enables you to manage the entire process of executing legal documents online. As a result, you save hours (if not days or even weeks) and eliminate unnecessary costs. From now on, complete the Indian Head Casino W-2G/Win-Loss Request Form from your home, workplace, or even while on the move.

- Access the form in the comprehensive online editor by clicking Get form.

- Complete the mandatory fields highlighted in yellow.

- Click the arrow labeled Next to transition from one field to another.

- Navigate to the electronic signature tool to e-sign the document.

- Enter the pertinent date.

- Review the entire document to ensure you haven’t overlooked anything.

- Click Done and save the finished document.

How to Modify Get Indian Head Casino W-2G/Win-Loss Request Form: Personalize Forms Online

Filling out documents is straightforward with intelligent web tools. Eliminate physical paperwork with easily downloadable Get Indian Head Casino W-2G/Win-Loss Request Form templates that you can modify online and print.

Preparing documents must be more accessible, whether it is a routine part of one’s job or occasional tasks. When someone needs to submit a Get Indian Head Casino W-2G/Win-Loss Request Form, learning the rules and guidelines on how to accurately fill out a form and what it should contain can consume significant time and effort. However, if you locate the appropriate Get Indian Head Casino W-2G/Win-Loss Request Form template, completing a document will no longer be a challenge with an intelligent editor available.

Explore a greater range of features you can incorporate into your document flow process. There’s no need to print, handwrite, and annotate forms manually. With an intelligent editing platform, all essential document processing features will always be accessible. If you’re looking to enhance your workflow with Get Indian Head Casino W-2G/Win-Loss Request Form forms, locate the template in the catalog, click on it, and discover an easier method to complete it.

The more tools you are familiar with, the easier it is to manage Get Indian Head Casino W-2G/Win-Loss Request Form. Try the solution that offers everything you need to find and edit forms in one browser tab and forget about physical paperwork.

- If you want to insert text in a specific section of the form or add a text field, utilize the Text and Text field tools and expand the text in the form as needed.

- Utilize the Highlight tool to emphasize the key points of the form. If you wish to conceal or eliminate certain text sections, use the Blackout or Erase tools.

- Personalize the form by incorporating default graphic elements. Use the Circle, Check, and Cross tools to add these features to the forms, if necessary.

- If you require extra annotations, take advantage of the Sticky note tool and place as many notes on the forms page as required.

- If the form needs your initials or date, the editor includes tools for that as well. Minimize the chances of mistakes by utilizing the Initials and Date tools.

- You can also add custom visual elements to the form. Use the Arrow, Line, and Draw tools to modify the document.

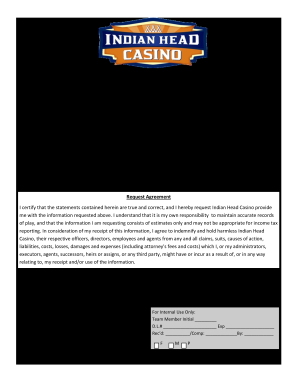

Win-Loss Statement: A single page letter showing estimated annual play activity (win or loss) based upon observable and/or carded gaming activity. W-2G Data: If you have won one or more jackpots exceeding $1,200.00 a report summarizing these winnings is available.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.