Loading

Get Huffman & Phelps Tax Service Schedule C Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Huffman & Phelps Tax Service Schedule C Worksheet online

This guide provides clear and reliable instructions on filling out the Huffman & Phelps Tax Service Schedule C Worksheet online. It is designed to assist users at all experience levels in accurately completing this essential tax form.

Follow the steps to complete your Schedule C Worksheet accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

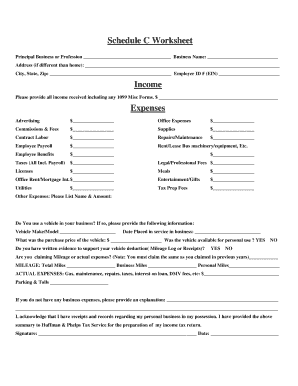

- Fill in your principal business or profession at the top of the form. Also, provide your business name, including the address if it differs from your home address. Ensure to include your city, state, zip code, and Employer Identification Number (EIN) if applicable.

- In the income section, report all income received during the tax year, including any amounts shown on 1099 Misc Forms.

- Move on to the expenses section. Here, you’ll report various expenses related to your business. Break down your expenses into categories such as advertising, office expenses, commissions & fees, supplies, contract labor, repairs/maintenance, employee payroll, rent/lease, employee benefits, taxes, legal/professional fees, licenses, meals, office rent/mortgage interest, entertainment/gifts, and utilities.

- If applicable, list any other expenses not categorized above in the 'Other Expenses' section, specifying the name and amount.

- If you use a vehicle for your business, provide the vehicle make/model, date placed in service, purchase price, availability for personal use, and whether you have written evidence to support your vehicle deduction.

- Indicate if you are claiming mileage or actual expenses, and complete the relevant fields for total miles, business miles, personal miles, or actual expenses.

- If you report no business expenses, provide a brief explanation.

- Sign and date the form, acknowledging that you have receipts and records related to your business in your possession.

- Review all entries for accuracy, then save your changes, download the completed document, print it, or share it as needed.

Start completing your documents online to ensure accurate and efficient tax filing.

Related links form

Worksheet C on the W-4 form is different and is used for calculating withholding allowances for employees. It helps employees determine how much tax to withhold from their paychecks. However, while this is distinct from the Huffman & Phelps Tax Service Schedule C Worksheet, both techniques support proper tax management. Each worksheet serves a specific aspect of tax filing, ensuring accuracy and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.