Loading

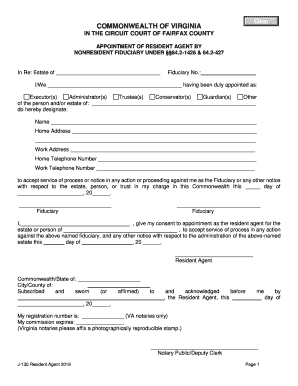

Get Appointment Of Resident Agent By Nonresident Fiduciary Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Appointment Of Resident Agent By Nonresident Fiduciary Form online

Filling out the Appointment Of Resident Agent By Nonresident Fiduciary Form is an essential step for nonresident fiduciaries managing estates in Virginia. This guide will walk you through the process step-by-step, ensuring that you can complete this form accurately and efficiently in an online format.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the name of the estate for which you are acting as a fiduciary in the space provided after 'In Re: Estate of.'

- Fill in the fiduciary number in the designated field, ensuring all information is accurate and up-to-date.

- In the next section, complete your name as the fiduciary. Indicate your role by checking the appropriate box for Executor, Administrator, Trustee, Conservator, Guardian, or Other.

- Provide the name of the person or estate you are managing in the space that appears after 'of the person and/or estate of:'.

- Designate your resident agent by writing their name in the space provided. Following that, complete the home and work address fields.

- Enter the home and work telephone numbers of the resident agent to facilitate contact.

- Record the date you are filling out the form where specified on the form.

- As a fiduciary, sign your name at the end of the designated section. If there are multiple fiduciaries, ensure each signs as necessary.

- The resident agent must then provide their consent by signing in the indicated area, confirming their acceptance of the role.

- Lastly, submit the form to be notarized, as indicated by the section requiring the notary's signature and registration number. After notarization, proceed to file the document.

Complete your documents online today for a seamless filing experience.

Rate of Tax The tax is assessed at the rate of 10 cents per $100 on estates valued at more than $15,000, including the first $15,000 of assets. For example, the tax on an estate valued at $15,500 is $15.50.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.