Get Section 125 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 125 form online

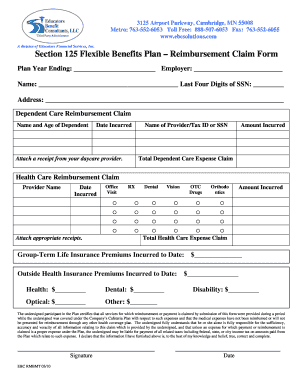

Filling out the Section 125 form online is an essential step for users looking to submit their reimbursement claims efficiently. This guide will walk you through the necessary steps to complete the form accurately, ensuring a smooth submission process.

Follow the steps to complete your Section 125 form online

- Click ‘Get Form’ button to access the Section 125 form and open it in your chosen editor.

- Begin by entering the plan year ending date and the employer's name in the designated sections.

- Provide your full name and the last four digits of your Social Security Number in the appropriate fields.

- Fill in your address comprehensively to ensure accurate correspondence.

- For dependent care reimbursement claims, list the name and age of each dependent, the date the expense was incurred, and the name of the provider along with their Tax ID or Social Security Number. Remember to attach a receipt from your daycare provider.

- Input the amount incurred for each dependent care claim and calculate the total dependent care expense claim.

- For health care reimbursement claims, specify the provider's name and the date incurred. Select the category of service by marking the relevant options (such as office visit, RX, dental, vision, OTC drugs, or orthodontics), and attach appropriate receipts.

- Enter the amount incurred for each category of health care services and calculate the total health care expense claim.

- Complete the sections for group-term life insurance premiums and outside health insurance premiums by entering the relevant amounts for health, dental, optical, disability, and any other applicable categories.

- Review the declaration statement, ensuring you understand your responsibilities regarding the accuracy of the claim. Finally, sign and date the form.

- Once you have filled out the form completely, save your changes. You may download, print, or share the completed document as necessary.

Start completing your Section 125 form online today for quick and accurate reimbursement.

Related links form

Eligibility Requirements This includes private sector businesses, including corporations, partnerships, limited liability companies and nonprofit organizations, as well as public sector employers. Also, as a general rule, an employer may allow any common law employee to participate in its Section 125 plan. Section 125 – Cafeteria Plans Overview | Sullivan Benefits sullivan-benefits.com https://.sullivan-benefits.com › wp-content › uploads sullivan-benefits.com https://.sullivan-benefits.com › wp-content › uploads

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.