Get Fha 203k(s) Initial Disbursement Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FHA 203K(S) Initial Disbursement Request online

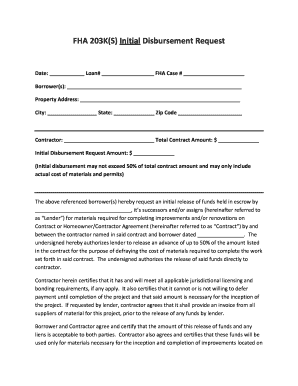

The FHA 203K(S) Initial Disbursement Request is a crucial document in accessing funds for home renovations. This guide provides clear instructions on how to complete this form online, ensuring you understand each section and field effectively.

Follow the steps to complete the FHA 203K(S) Initial Disbursement Request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date, loan number, and FHA case number in the designated fields. Ensure all information is accurate to avoid processing delays.

- Complete the borrower information section with the names and contact details of the individuals requesting the funds.

- Fill in the property address, including the city, state, and zip code, where the renovations will take place.

- Provide the contractor's name and the total contract amount. This should reflect the agreed-upon cost for the renovation work.

- Specify the initial disbursement request amount, which must not exceed 50% of the total contract amount. Include only actual costs associated with materials and permits.

- Review the authorization statement and ensure that both the borrower and contractor understand their responsibilities concerning the initial release of funds.

- Have all parties involved sign the document, including both borrowers and the contractor, ensuring that all signatures are collected before submission.

- Finally, save the changes, then download, print, or share the completed form as needed.

Complete your FHA 203K(S) Initial Disbursement Request online now to facilitate your home renovation funding.

Typically, FHA 203K(S) Initial Disbursement Request loans may come with slightly higher interest rates. This is due to the associated risks of renovation financing and the nature of the program. However, competitive rates are available, and many borrowers find the benefits outweigh the costs. Researching your options and working through a trusted platform, like uslegalforms, can help ensure you secure the best possible terms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.