Loading

Get Form Vat- M1 - Vatfaq.in

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

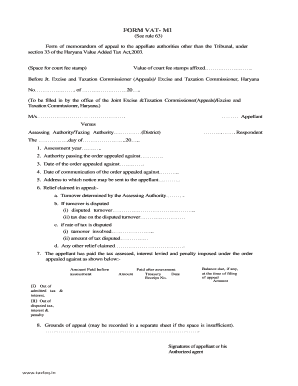

How to fill out the FORM VAT- M1 - Vatfaq.in online

Filling out the FORM VAT- M1 online can be a straightforward process when you understand each section and field of the form. This guide provides easy-to-follow steps to help you complete the form accurately and efficiently.

Follow the steps to fill out the FORM VAT- M1 online:

- Click the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Identify the section for the appellant's information. Enter the name of the appellant exactly as it appears on the relevant documents.

- Fill in the respondent details. Specify the name of the assessing authority or taxing authority along with the district.

- Complete the fields related to the assessment year and the authority passing the order being appealed against.

- Provide the dates for the order being appealed and the communication of that order. This information is crucial for the appeal process.

- In the section for relief claimed in appeal, list the turnover determined by the assessing authority and indicate if any of it is disputed. Include specific figures for disputed turnover and tax.

- Detail any taxes, interests, or penalties that have been paid related to the order appealed against. Ensure you include amounts paid before and after assessment along with the treasury details.

- Outline the grounds for the appeal. If more space is needed, use a separate sheet to document all grounds clearly.

- Sign the form, providing the signature of the appellant or their authorized agent. Ensure that verification is completed and dated as required.

- Finally, save changes made to the form. You can download, print, or share it as needed for your records.

Complete your FORM VAT- M1 online today for a smoother filing experience.

VAT (value-added tax), on the other hand, is collected by all sellers in each stage of the supply chain. Suppliers, manufacturers, distributors, and retailers all collect VAT on taxable sales. Similarly, suppliers, manufacturers, distributors, retailers, and end consumers all pay VAT on their purchases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.