Get Fannie Mae 1088 1996-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae 1088 online

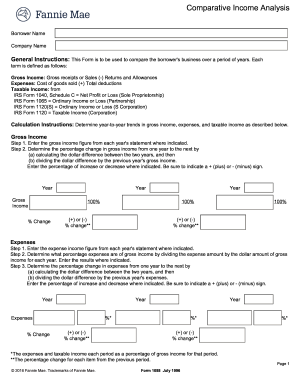

The Fannie Mae 1088 form is essential for lenders to assess the financial viability of self-employed borrowers by comparing their business performance over time. This guide provides a clear, step-by-step approach to completing the form online, ensuring a smooth experience for users regardless of their prior knowledge.

Follow the steps to fill out the Fannie Mae 1088 form successfully.

- Click the ‘Get Form’ button to access the Fannie Mae 1088 form and open it in your preferred editor.

- Begin by entering the gross income in the designated field. This value should represent the total gross receipts minus any returns and allowances.

- Next, input your expenses in the corresponding section. This should include the sum of cost of goods sold and total deductions.

- Calculate the taxable income using one of the appropriate IRS forms. Choose from IRS Form 1040 (Schedule C), IRS Form 1065, IRS Form 1120, or IRS Form 1120S as applicable, and fill in the taxable income based on your business structure.

- Review the entries carefully to ensure all figures are accurate and reflective of your financial statements.

- Once you have filled out all sections of the form, use the options available to save your changes, download a copy, print the document, or share it as needed.

Complete your Fannie Mae 1088 form online today to facilitate your lending process.

The 1088 form is utilized primarily for reporting real estate transactions to the IRS. This form ensures that any income generated from these transactions is properly documented and taxed. Familiarizing yourself with the 1088 form can help streamline your tax preparation process. For more guidance, US Legal Forms offers a helpful toolkit for understanding 1088 and related forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.