Loading

Get Self Certification For Entities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Certification For Entities online

The Self Certification For Entities is an essential form that collects vital information about an entity’s tax residency and compliance status. This guide provides clear, step-by-step instructions on how to fill out the form online, ensuring the process is smooth and straightforward for all users.

Follow the steps to complete the Self Certification For Entities effectively.

- Press the ‘Get Form’ button to obtain the Self Certification For Entities form and open it in your preferred editor.

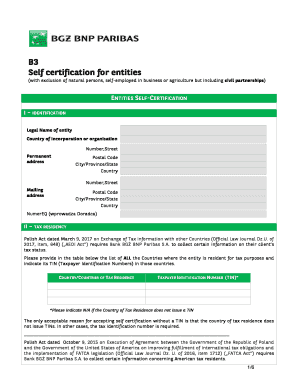

- In the Identification section (I), fill in the legal name of the entity, the country of incorporation or organization, and the permanent address, including the street number, postal code, city/province/state, and country. If the mailing address is different, fill in that information as well.

- Move to the Tax Residency section (II). Here, provide a comprehensive list of all countries where the entity is a tax resident, along with the corresponding Taxpayer Identification Numbers (TINs). If a country does not issue TINs, clearly indicate this by writing 'N/A'.

- In the FATCA and AEOI Statuses section (III), select the appropriate entity type (A, B, C, or D) by ticking the box that corresponds to the entity's classification. Complete any additional information required based on the selected status.

- If the entity is classified under Passive Non-Financial Entity (Status D) or Investment Entity, complete Section IV regarding Information on Controlling Persons by including the required details in the table provided.

- Review the Privacy Notice and Confidentiality section (V) to understand how personal information will be handled and the requirements for disclosing this data.

- Complete the Certification section (VI) at the end of the form by declaring the accuracy of the information provided. Ensure to include the date, place, names, capacities, and signatures of the authorized representatives.

- After filling out all sections, review the form for completeness and accuracy. You can then save your changes, download the document, print it, or share it as needed.

Begin completing the Self Certification For Entities online today for a seamless and compliant process.

Self-certification is the process whereby a Financial Institution asks their Account Holders to certify a number of details about themselves in order to determine the country/countries in which they are tax resident. We are required to collect this information from you under both FATCA and CRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.