Loading

Get Collegeboundfund Withdrawals And Outgoing Transfers/rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CollegeBoundfund Withdrawals and Outgoing Transfers/Rollover Form online

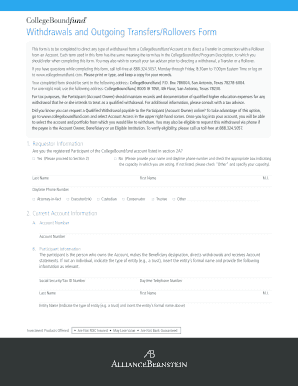

The CollegeBoundfund Withdrawals and Outgoing Transfers/Rollover Form is essential for managing your CollegeBoundfund account. This guide will walk you through each step of the form, ensuring you can complete it with confidence.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the CollegeBoundfund Withdrawals and Outgoing Transfers/Rollover Form and open it for editing.

- In Section 1, provide the requestor information. If you are the registered participant listed in Section 2A, select 'Yes' and proceed to Section 2. If not, enter your information including last name, first name, middle initial, and daytime phone number. Specify your role using the given options.

- Section 2 asks for current account information. Enter the account number in Section 2A. In Section 2B, fill out the participant’s details. If the participant is an entity, provide the entity’s name and the relevant information. For beneficiary details, complete Section 2C with their social security or tax ID number, date of birth, last name, first name, and middle initial.

- In Section 5, provide payment instructions. Indicate if the payment will be made to the participant, beneficiary, or another qualified institution. Fill in the necessary details including names, account numbers or student IDs, and mailing addresses.

- After successfully completing the form, review all fields for accuracy. You can then save the changes, download, print, or share your completed form according to your needs.

Complete your CollegeBoundfund Withdrawals and Outgoing Transfers/Rollover Form online today!

Transferring ownership of a 529 plan is generally not considered a taxable event. However, be mindful of specific circumstances that might incur taxes, especially if the new owner is not a qualified relative of the original account holder. Using the CollegeBoundfund Withdrawals and Outgoing Transfers/Rollover Form can guide you through this process and ensure compliance with regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.