Loading

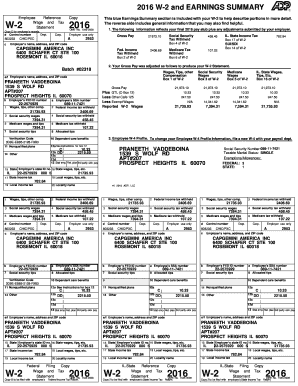

Get The Following Information Reflects Your Final 2016 Pay Stub Plus Any Adjustments Submitted By Your

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the following information reflects your final 2016 pay stub plus any adjustments submitted by your employer online

This guide provides a clear and comprehensive approach to filling out the form titled 'The Following Information Reflects Your Final 2016 Pay Stub Plus Any Adjustments Submitted By Your Employer.' Follow these instructions carefully to ensure accurate and complete submission of your tax-related information online.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This includes your name, address, and Social Security number, ensuring accuracy to avoid discrepancies.

- Next, locate the sections that specify your gross pay, taxes withheld, and other relevant earnings. Fill in these fields using the information provided in your final pay stub.

- Review the federal income tax withheld, Social Security wages, and Medicare wages fields to confirm they reflect the correct amounts as per your records.

- If applicable, update any adjustments or changes in the Employee W-4 profile section. This is essential for correct tax withholding.

- Ensure all figures are accurate as mistakes can lead to issues with tax filings.

- Once all applicable sections are filled, save your changes and proceed to download, print, or share the form as needed.

Start filling out your documents online today to ensure timely and accurate submissions.

Related links form

Is a W-2 the Same as a Pay Stub? No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.