Loading

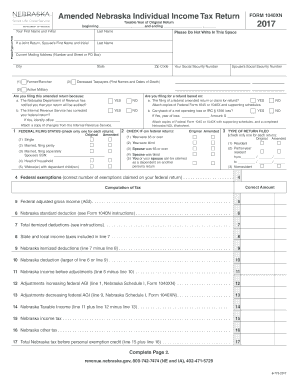

Get 1 Federal Filing Status (check Only One For Each Return):2 Check If (on Federal Return):

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 Federal Filing Status (check only one for each return): 2 Check if (on federal return): online

Filling out your Federal Filing Status correctly is crucial for accurate tax reporting. This guide offers step-by-step instructions to help users of all experience levels successfully complete this section of the tax return online.

Follow the steps to accurately complete your federal filing status.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online platform.

- Locate the section labeled '1 Federal Filing Status (check only one for each return)'. Here, you will see options to check based on your current situation.

- Review the options carefully and check the appropriate box that corresponds to your filing status: Single, Married filing jointly, Married filing separately, Head of household, or Widow(er) with dependent child(ren).

- Proceed to the next section labeled '2 Check if (on federal return)'. This section requires you to check boxes if applicable conditions are met: you were 65 or older, you were blind, or you could be claimed as a dependent on someone else's returning.

- After completing this section, ensure all information is accurate before saving your entries. Review your selections for correctness.

- Finally, save your changes, then you can download, print, or share the form as needed.

Complete your tax documents online to ensure you are filing accurately and efficiently.

In common usage, the term 'single' is often used to refer to someone who is not involved in either any type of sexual relationship, romantic relationship, including long-term dating, engagement, marriage, or someone who is 'single by choice'.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.