Loading

Get Supplementary Life Insureds Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Supplementary Life Insureds Statement online

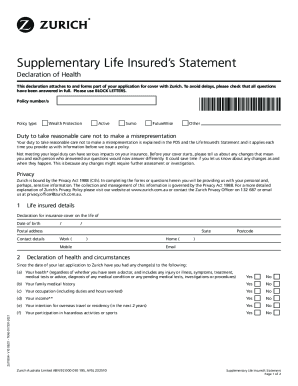

Completing the Supplementary Life Insureds Statement online is a crucial step in your insurance application process. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the 'Get Form' button to obtain the Supplementary Life Insureds Statement and open it in your editor.

- Fill in the policy number and policy type section. Ensure you select the relevant type, such as Wealth Protection, Active, Sumo, FutureWise, or Other.

- Complete the life insured details section. Enter the full name of the person insured, their date of birth, postal address, and contact details, including work, home, mobile, and email.

- Move on to the declaration of health and circumstances section. Answer each question regarding changes in health, family medical history, occupation, income, intention for overseas travel, and participation in hazardous activities. Select 'Yes' or 'No' for each question.

- If you answered 'Yes' to any question, provide detailed information as requested. This includes specific health-related treatments, details regarding your occupational duties, and any changes in your income.

- Read and understand the declaration at the bottom of the form. You must confirm that the statements and answers in your application are true and complete. Provide your name, sign, and date the document.

- Once you have completed all sections, save your changes. You may then save the document, download it, print it, or share it as needed.

Complete your Supplementary Life Insureds Statement online today for a seamless insurance application process!

Related links form

Dividends are not guaranteed. Indeterminate Premium Whole Life: An indeterminate premium whole life policy is like a non-participating whole life plan of insurance except that it provides for adjustable premiums.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.