Loading

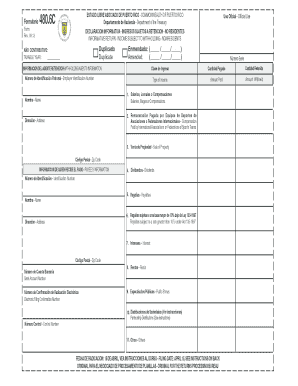

Get 480.6c Rev. 09.12. 480.6c Rev. 09.12

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 480.6C Rev. 09.12 online

Filling out the 480.6C Rev. 09.12 form online can streamline your experience with tax submission regarding income subject to withholding for nonresidents in Puerto Rico. This guide provides detailed steps to assist users, regardless of their legal background, in completing the form accurately.

Follow the steps to complete the 480.6C Rev. 09.12 form online.

- Press the ‘Get Form’ button to obtain the 480.6C Rev. 09.12 form and access it in your preferred online editor.

- Indicate the taxable year in the designated field for 'AÑO CONTRIBUTIVO'. Use the appropriate format for the date, following the provided examples for clarity.

- Complete the amended section only if the form is a correction of a previously submitted form. Enter the relevant dates in the 'Enmendado' section as needed.

- Provide the withholding agent's information. This includes the Employer Identification Number (Número de Identificación Patronal) and the type of income being reported (Clase de Ingreso). Fill in the amounts paid (Cantidad Pagada) and amounts withheld (Cantidad Retenida) for each income type.

- List the payee's information in the designated section. Include their Identification Number and other relevant fields such as name, address, and postal code. This is crucial to ensure accurate processing of the tax information.

- Make sure to record any bank account details in the designated area for transfer purposes, if applicable.

- Review all entered information for accuracy before submitting the form. Ensure that the type of income and corresponding amounts have been listed correctly.

- Once the form is complete, save your changes. You can download, print, or share the document according to your requirements before final submission.

Complete your documents online today to ensure timely processing and compliance with tax regulations.

Corporations not engaged in a trade or business in Puerto Rico are subject to a 29% WHT at source on certain gross income items (considered fixed or determinable, annual or periodical [FDAP]) from Puerto Rico sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.