Loading

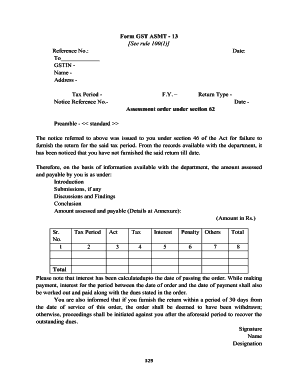

Get Form Gst Asmt - 13 See Rule 100(1) Reference No.: Date ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form GST ASMT - 13 See Rule 100(1) Reference No.: Date ... online

Form GST ASMT - 13 pertains to the assessment order for taxpayers who have failed to furnish their returns. This guide provides user-friendly, step-by-step instructions on how to fill out this form online for effective compliance.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the reference number and date at the top of the form. Ensure these are accurate, as they identify your case.

- Provide your GSTIN, name, and address in the designated sections. This information must reflect your official details for processing.

- Specify the tax period relevant to the assessment, along with any applicable notice reference numbers. Make sure that the dates align with your records.

- Review the assessment order section for any detailed findings or discussions that pertain to your case. If you have any submissions or counter-arguments, document them in the appropriate sections.

- In the amount assessed and payable section, fill out the details regarding tax, interest, penalty, and any other amounts. Refer to the annexure for exact figures and ensure accuracy.

- Sign the form at the end, and include your name and designation to finalize the document.

- Once completed, save the changes, download the form for your records, print a copy if required, or share it as necessary.

Complete your Form GST ASMT - 13 online to ensure timely compliance.

ing to section 50(1) of the Central Goods and Services Tax (CGST) Act 2017, the taxpayer should pay interest on GST liability if the following instances: Fails to pay such GST within the period as stipulated above. Makes short payment for the GST.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.