Loading

Get Mortgage Valuation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Valuation online

This guide provides a clear and comprehensive approach to filling out the Mortgage Valuation form online. You will find step-by-step instructions to ensure all sections are completed accurately and thoroughly.

Follow the steps to successfully complete the Mortgage Valuation form online.

- Click ‘Get Form’ button to access the Mortgage Valuation form and open it in the designated editor.

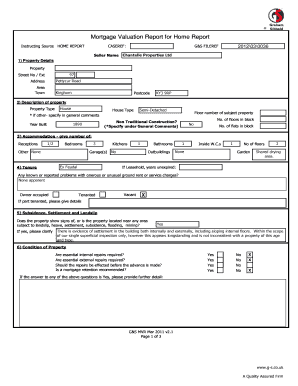

- Begin with the property details section. Fill in the property address, including street number, road name, town, and postcode. Ensure accuracy as this information is essential for the valuation.

- Now, provide accommodation details by noting the number of receptions, bedrooms, kitchens, bathrooms, and garages. Be precise, as this will impact the valuation.

- In the subsidence, settlement, and landslip section, carefully denote any existing issues with the property or surrounding area. This could affect the mortgage approval process.

- List the services available to the property, such as mains water, drainage, electricity, and gas. This section helps lenders understand the utility provisions.

- Calculate the insurance reinstatement value by including the total floor area measured internally and the estimated cost for rebuilding.

- Fill in any general comments about the property features and location, which could influence the valuation positively or negatively.

Complete your Mortgage Valuation document online today for a seamless mortgage application process.

Get a mortgage offer – Most banks will issue a mortgage offer within a few days of receiving your property valuation report, as long as they have all the other necessary information. It can take around five days to receive the report, so the time between valuation and mortgage offer is typically one week.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.