Loading

Get Iht408

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht408 online

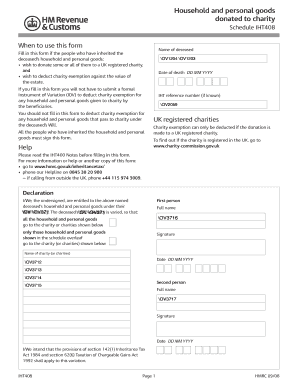

The Iht408 form is essential for individuals who wish to donate household and personal goods to a UK registered charity while claiming charity exemption against the value of the estate. This guide provides a clear and detailed walkthrough to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the Iht408 form online.

- Press the ‘Get Form’ button to access the Iht408 form and open it for editing.

- Enter the name of the deceased in the designated field. This information is crucial for identifying the estate linked to the donations.

- Fill in the date of death using the format DD MM YYYY. This date is important for the context of the estate and its valuation.

- If available, provide the IHT reference number to help categorize the submission accordingly.

- In the declaration section, list all individuals who have inherited the household and personal goods, ensuring each has a space to sign.

- Specify whether the deceased's Will is being varied. Mark the appropriate checkbox confirming the stipulations regarding the goods donated.

- Detailed description of items donated should be provided; indicate specifics such as furniture or broad categories like clothing. Record the name of the charity receiving the items.

- Assign a value to the donated items, detailing it in the relevant field. Ensure accuracy as this will affect the overall estate value.

- Total the values of the donated goods and include this amount on form IHT 400 at box 92.

- After thoroughly reviewing all entries for accuracy, save your changes, and proceed to download, print, or share the completed form as needed.

Start completing the Iht408 online today to simplify your process of donating to charity.

Use the IHT404 with form IHT400 to give details of all UK assets the deceased owned jointly with another person.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.