Loading

Get Form 7216 Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 7216 Sample online

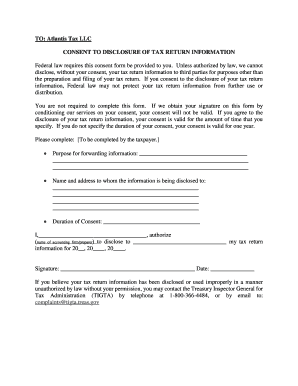

Filling out the Form 7216 Sample is an important step in authorizing the disclosure of your tax return information. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately.

Follow the steps to fill out the Form 7216 Sample online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the section labeled 'Purpose for forwarding information,' fill in the reason you are allowing your tax return information to be disclosed. Provide a detailed explanation to avoid any ambiguity.

- Locate the section for 'Name and address to whom the information is being disclosed to.' Enter the full name and address of the individual or organization that will receive your tax return information.

- Specify the 'Duration of Consent.' Indicate how long you want the consent to be valid. If no duration is specified, it will be valid for one year by default.

- In the line labeled 'I, _______ authorize,' fill in the name of the accounting firm or preparer who will be disclosing your information. This identifies who you give permission to share your tax return details.

- Provide the tax years for which you are authorizing the consent by entering the relevant years in the spaces provided, such as 20__, 20__, 20__.

- Sign the form where indicated and include the date of your signature. This completes your authorization.

Complete your documents online today for hassle-free management.

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.