Get Lbtapprove Osceola Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lbtapprove Osceola Org online

Completing the Lbtapprove Osceola Org form online can seem daunting, but this guide is designed to help simplify the process. Follow the steps below for clear and concise instructions on filling out each section of the form accurately.

Follow the steps to complete your form with ease.

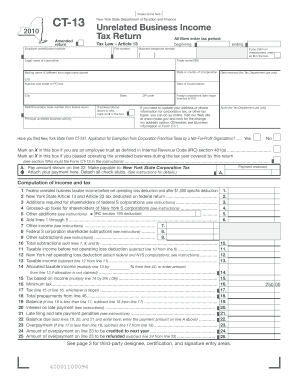

- Press the ‘Get Form’ button to download the form and open it for editing.

- Begin by entering your employer identification number at the top of the form. This is essential for your tax identification.

- Record the tax period for which you are filing, including both the starting and ending dates.

- Fill in your business telephone number and provide the legal name of the corporation. If your business operates under a different trade name, include that as well.

- If your mailing name differs from the legal name, include that information as well, along with your state or country of incorporation.

- Indicate the date of incorporation and provide the specific NAICS business code number from your federal return.

- State the principal unrelated business activity conducted by your corporation.

- If you are claiming an overpayment, mark an X in the designated box.

- Follow the computation of income and tax section, entering the necessary information as requested in the individual lines. Ensure to attach any required documentation, particularly for deductions and additions.

- Complete the payment section, ensuring to indicate the amount you are enclosing. Detach all check stubs as necessary.

- Fill out the audit questions as applicable, including information regarding whether you have been audited by the IRS in the last five years.

- If you did not maintain a regular place of business outside New York State, complete the unrelated business allocation section only if applicable.

- Finalize by signing the certification area at the bottom of the form, including your title and email address.

- Once completed, save your changes and choose to download, print, or share your form as needed.

Complete your documents online today for a compliant and efficient filing experience.

Related links form

You can obtain business tax receipts by applying in person at your local tax collector's office, by mail, or online.

Fill Lbtapprove Osceola Org

Enter your Business License search criteria below. Use the Start Date and End Date fields to enter parameters for the date the license was first issued. Find contractor licensing information for Osceola County, including a list of frequently asked questions. Visit their website for more information. Get your Osceola County Business Tax Receipt. All businesses in the City of Kissimmee must have both a City of Kissimmee and an Osceola County BTR. The official website of Osceola County, Florida. Find information on building permits, contractor licensing, zoning regulations, impact and mobility fees, and more.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.