Loading

Get Atlanta Ga 39901-0010

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Atlanta GA 39901-0010 online

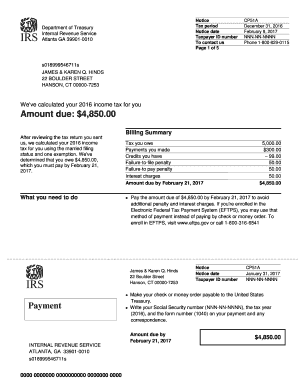

The Atlanta GA 39901-0010 form, formally known as CP51A, is crucial for individuals who have received a notice regarding their income tax calculations. This guide will provide clear steps to help you effectively navigate the completion of this form online, ensuring that you address the necessary components accurately.

Follow the steps to successfully complete the Atlanta GA 39901-0010 online:

- Press the ‘Get Form’ button to access the Atlanta GA 39901-0010 form, allowing you to open and view it in the designated online editor.

- Review the notice date and taxpayer ID number on the form. Ensure that the information matches any prior correspondence you have received from the IRS.

- Fill in the personal details as required, including the names and address of the taxpayers involved in the notice, verifying the accuracy of all entries.

- Carefully examine the billing summary section to confirm the amount due of $4,850.00 by February 21, 2017. Make a note of any payments made, credits available, and any applicable penalties.

- If you are unable to pay the full amount, fill out the required information to indicate how much you can currently pay and request payment arrangements.

- If applicable, check any boxes that indicate included correspondence or changes in contact information, then provide your primary and secondary phone numbers.

- Finally, review all the information for accuracy and completeness. Save your changes, then download, print, or share the form as necessary before submission.

Complete your documents online today for a seamless filing experience.

Related links form

Write both the destination and return addresses clearly or print your mailing label and postage. If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS® blue collection box or at a Postal location that has a pickup time before the deadline.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.