Loading

Get Rental Property Schedule Ato

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rental Property Schedule Ato online

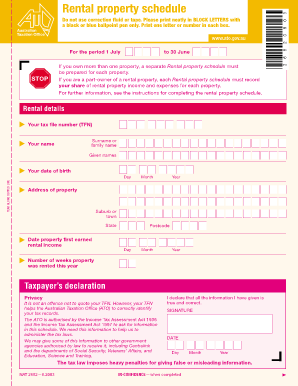

Filling out the Rental Property Schedule Ato accurately is essential for reporting rental income and expenses to the Australian Taxation Office. This guide provides a straightforward, step-by-step approach to completing the form online, ensuring that all necessary information is captured correctly.

Follow the steps to complete your Rental Property Schedule Ato online.

- Click ‘Get Form’ button to obtain the Rental Property Schedule Ato and begin the process in your online document editor.

- Enter your tax file number (TFN) in the designated field. While not mandatory, providing your TFN helps the ATO to identify your tax records accurately.

- Fill in your surname or family name, given names, and date of birth. Ensure you enter this information clearly and accurately.

- Provide the address of the rental property, including suburb or town, state, and postcode.

- Record the date when the property first earned rental income, ensuring you format the date correctly.

- Indicate the number of weeks the property was rented during the year. This information is crucial for calculating your rental income.

- In the income section, report your total rental income and any other rental-related income clearly in the designated fields.

- List the allowable expenses related to the property. Each expense category has a specific field — be detailed and accurate.

- Total your expenses and income by following the instructions on the form. Subtract total expenses from gross rental income to determine your net rent.

- Complete the taxpayer’s declaration by signing and dating the form to certify that all information provided is true and correct.

- Finally, save your changes, download the completed form, or print and share it as needed.

Start completing your Rental Property Schedule Ato online today for accurate reporting.

If you earn an income from renting out property, you may have to complete a self-assessment tax return and pay income tax....Personal allowance and income tax bands. Portion of incomeTax rate£12,750 - £50,27020% (basic rate)£50,271 - £150,00040% (higher rate)£150,000 +45% (additional rate) 9 Jan 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.