Loading

Get Streamlined Application For Recognition Of Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Streamlined Application For Recognition Of Exemption online

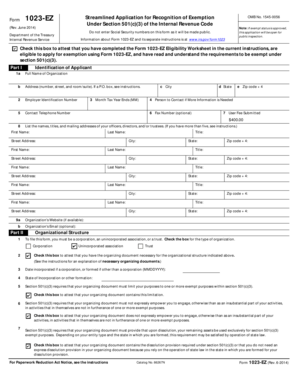

The Streamlined Application For Recognition Of Exemption is a vital document used by organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This guide provides clear, step-by-step instructions to assist users in correctly completing this application online.

Follow the steps to efficiently fill out your application.

- Press the ‘Get Form’ button to access the application and open it in your preferred online editor.

- Begin by filling out Part I, which includes your organization's full name, address, and Employer Identification Number. Ensure that all details are accurate and up to date.

- Provide contact information for a designated person, including their telephone number and optional fax number. This person should be available for any follow-up inquiries.

- List the names, titles, and addresses of your officers, directors, or trustees. If your organization has more than five, refer to the additional instructions.

- In Part II, indicate your organizational structure by checking the appropriate box for corporation, unincorporated association, or trust. Confirm that you possess the necessary organizing documents.

- Attest that your organizing document limits your purposes to those outlined under section 501(c)(3) and does not allow substantial engagement in activities not furthering exempt purposes.

- Fill out Part III by entering the NTEE code that aligns with your organization's activities. Check all boxes that apply to attest that your organization meets the requirements for exemption.

- Indicate whether your organization will be involved in activities like influencing legislation, providing compensation, or conducting unrelated business. Answer all questions truthfully.

- In Part IV, classify your organization as either a public charity or a private foundation. Follow the instructions to determine the appropriate classification and check the corresponding box.

- Finally, review your application thoroughly before submission. You can save changes, download a copy for your records, and share it with designated individuals if needed.

Complete your Streamlined Application For Recognition Of Exemption online today to streamline your path to tax-exempt status.

If the IRS approves your application, you will receive a favorable determination letter, which explains your rights and responsibilities as a tax-exempt organization. Donors and grantors might request to see your determination letter for proof of your tax-exempt status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.