Loading

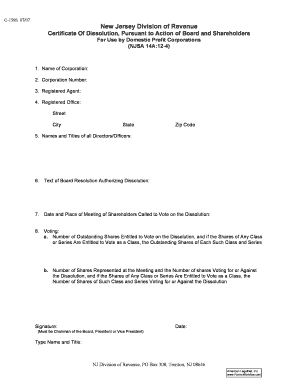

Get C-159a Certificate Of Dissolution Form To Dissolve A Profit Corporation Pursuant To Action Of Board

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C-159A Certificate Of Dissolution Form To Dissolve A Profit Corporation Pursuant To Action Of Board online

The C-159A Certificate of Dissolution form is essential for dissolving a profit corporation in New Jersey. This guide provides a clear, step-by-step approach to successfully complete the form online, ensuring that you meet all necessary requirements for a smooth dissolution process.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the C-159A Certificate of Dissolution form. This will open the form in your preferred online editor.

- In the first field, enter the name of the corporation exactly as it appears in official documents.

- In the next section, fill in the corporation number, which is the 10-digit identifier assigned when the corporation was formed.

- Provide the name of the current registered agent responsible for handling legal documents on behalf of the corporation.

- Next, enter the registered office address, which must include the street, city, state, and zip code. Ensure this address is located in New Jersey.

- List the names and titles of all current directors and officers of the corporation. If more space is needed, attach an additional sheet.

- Insert the text of the board resolution that authorizes the dissolution. If this requires more space, include it as an attachment.

- Indicate the date and location of the shareholders' meeting where the dissolution vote occurred.

- Complete the voting section: state the number of outstanding shares entitled to vote on the dissolution. If there are different classes of shares, provide the details for each class.

- Finally, provide the number of shares represented at the meeting and the count of shares that voted for or against the dissolution. Again, if there are class distinctions, include that information.

- The form must be signed and dated by the Chairman of the Board, President, or Vice President. Type their name and title underneath the signature.

- Once all fields are filled, ensure that the form is complete and correct. You can then save your changes, download a copy, print it, or share the completed form as needed.

Start the form completion process online today to ensure your corporation is dissolved efficiently.

As required by law, a nonprofit organization that is ceasing existence is required to transfer all remaining assets to another tax-exempt organization or to the government. It is unlawful to give any property away to individuals – including board members, volunteers, staff, or beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.