Loading

Get Service - Pay-per Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Service - Pay-Per Payroll online

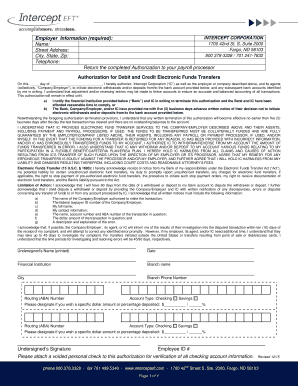

Filling out the Service - Pay-Per Payroll form is an essential step for users authorizing electronic fund transfers. This guide will provide you with clear instructions on completing the form accurately and efficiently.

Follow the steps to complete the Service - Pay-Per Payroll form online:

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

- Provide your employer information. Fill in the name, address, and contact number of your employer as specified in the fields provided.

- In the Authorization section, enter the date and your name, granting Intercept Corporation the authority to process electronic withdrawals and deposits for your account.

- Enter your bank details, including the bank name, routing number, account type (checking or savings), and whether you want a specific dollar amount or percentage deposited.

- Complete the section for any future changes by indicating your understanding of how to terminate this authorization if necessary.

- Review the acknowledgement of the Electronic Funds Transfer Act responsibilities and the limitation of action provisions, ensuring you are aware of your rights and obligations.

- Sign the form at the designated area, ensuring your name is printed clearly, and include your employee ID number if applicable.

- Attach a voided personal check to verify your checking account information as required.

- After completing all fields, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online to ensure a smooth processing experience.

The cost of payroll services can range anywhere from $30 to $200 per month for a base account. In addition to a base account fee, payroll processing is usually charged per employee on average $10 to $25 per month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.