Loading

Get Capital Recovery Factor Table

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Capital Recovery Factor Table online

The Capital Recovery Factor Table is a vital tool for calculating the annual payments required to repay loans. This guide provides a comprehensive walkthrough to help you efficiently fill out this table online, ensuring accurate financial projections for your projects.

Follow the steps to effectively complete your Capital Recovery Factor Table online.

- Press the ‘Get Form’ button to access the Capital Recovery Factor Table and open it in your preferred online editor.

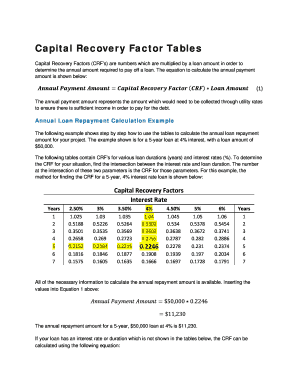

- Identify the loan amount you will be working with. This is a crucial figure since the Capital Recovery Factor will be multiplied by this amount to calculate your annual payment.

- Select the interest rate applicable to your loan. Navigate through the table to locate the row representing your chosen interest rate.

- Determine the loan duration in years. Move to the corresponding column that matches the length of your loan.

- Find the intersection of the selected interest rate and loan duration in the table. The number at this intersection is your Capital Recovery Factor (CRF).

- Use the identified CRF in the provided equation to calculate the annual payment amount. Multiply the CRF by the loan amount to obtain this figure.

- If your interest rate or loan duration is not listed, use the alternative equation to calculate the CRF and then apply it to the annual payment calculation.

- Review all entries for accuracy before finalizing. Ensure all figures are correct based on your loan parameters.

- Once completed, you can save your changes, download, print, or share the Capital Recovery Factor Table as needed.

Start filling out your Capital Recovery Factor Table online today to manage your loan projections effectively.

Equation 1-6 The factor [i(1+i)n]/[(1+i)n−1] is called the “capital-recovery factor” and is designated by A/Pi,n. This factor is used to calculate a uniform series of end of period payment, A that are equivalent to present single sum of money P.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.