Loading

Get Section 125 Plan Document Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 125 Plan Document Template online

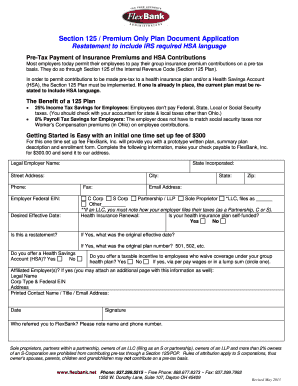

Filling out the Section 125 Plan Document Template online is a straightforward process that allows employers to set up pre-tax contributions for health insurance premiums and Health Savings Accounts. This guide will provide you with clear, step-by-step instructions tailored to help you complete the document efficiently.

Follow the steps to complete your Section 125 Plan Document Template online.

- Click the ‘Get Form’ button to obtain the Section 125 Plan Document Template and open it in your online editor.

- Begin by entering your legal employer name in the appropriate field. This must reflect the official name registered with tax authorities.

- Next, specify the state in which your business is incorporated. This is crucial for ensuring compliance with state regulations.

- Fill in your street address, city, and zip code. These fields should include the complete address where your business operates.

- Enter your contact phone number and fax number, ensuring they are current for any necessary communications.

- Provide your Employer Federal EIN (Employer Identification Number) which is essential for tax reporting.

- Indicate the desired effective date for the Section 125 Plan. This is the date you would like the plan to start.

- Specify whether this submission is a restatement of an existing plan, marking 'Yes' or 'No' as applicable.

- Select your entity type from the provided options: C Corp, S Corp, Partnership/LLP, Sole Proprietor, LLC, or Other. If applicable, clarify the filing status of your LLC.

- If you are offering Health Insurance, indicate whether your plan is self-funded by answering 'Yes' or 'No'. If 'Yes', provide the original effective date and plan number.

- State whether you offer a Health Savings Account (HSA) by selecting 'Yes' or 'No'.

- Answer whether you provide a taxable incentive for employees who waive coverage under your group health plan, and if 'Yes', specify the method.

- If you have affiliated employers, provide their legal names, corporation types, and federal EINs as needed.

- Complete the printed contact name, title, and email address for future correspondence.

- Enter the date of completion and include your signature to validate the document.

- Lastly, indicate who referred you to FlexBank by providing their name and phone number.

- After filling out the form, save your changes. You have the option to download, print, or share the completed document as needed.

Start filling out your Section 125 Plan Document Template online today to manage your employee benefits efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

125 is the grand total of all your pre-tax deductions EXCEPT annuities. 2022. W-2 FAQs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.