Loading

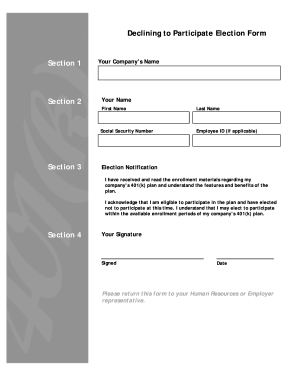

Get Declining To Participate Election Form - Inr 401k

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declining To Participate Election Form - InR 401k online

Filling out the Declining To Participate Election Form - InR 401k online can be straightforward if you follow the right steps. This guide will provide you with clear and concise instructions to ensure you complete the form accurately.

Follow the steps to complete the Declining To Participate Election Form - InR 401k online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section 1, enter your company’s name. Make sure to specify the full name as it appears in official documents.

- In section 2, fill in your first name and last name. Ensure that you use your legal names as they appear on your identification.

- Provide your Social Security Number in section 3. This information is essential for identification and must be accurate.

- If applicable, include your Employee ID. This will help your employer process your form efficiently.

- In the Election Notification section, confirm that you have received and read the enrollment materials regarding your company’s 401(k) plan by checking the box.

- Acknowledge your eligibility to participate and your decision not to participate at this time by checking the box provided.

- In section 4, provide your signature to indicate your consent and understanding of the form.

- Date your signature to ensure the form is current.

- Submit the completed form to your Human Resources or Employer representative as instructed.

Complete your documents online today to ensure your preferences are accurately recorded.

A 401(k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee's wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.