Loading

Get Form 211

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 211 online

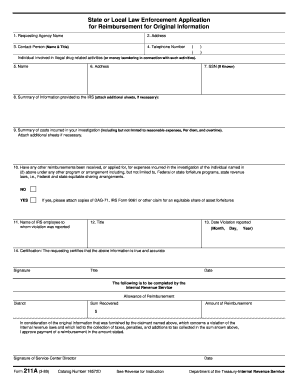

This guide provides clear and comprehensive instructions for completing Form 211 online, specifically designed for state or local law enforcement agencies seeking reimbursement for original information. By following the steps outlined below, users can ensure that their application is filled out accurately and thoroughly.

Follow the steps to complete Form 211 online effectively.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter the requesting agency name in the designated field.

- Provide the agency's address in the required section, ensuring accuracy.

- Fill in the contact person's name and title for correspondence.

- Include a valid telephone number where you can be reached.

- In the section for the individual involved, provide the name of the person associated with illegal drug-related activities or money laundering.

- Enter the individual's address in the appropriate field.

- If known, include the Social Security Number (SSN) of the individual.

- Summarize the information that was provided to the IRS; if more space is needed, attach additional sheets.

- Outline any costs incurred during the investigation, including expenses, per diem, and overtime; attach additional sheets if necessary.

- Indicate if any other reimbursements have been received or applied for regarding this investigation, checking ‘Yes’ or ‘No’.

- If you answered ‘Yes’, attach copies of necessary documentation like DAG-71 or IRS Form 9061.

- Provide the name of the IRS employee to whom the violation was reported.

- Enter the title of the IRS employee.

- Fill in the date when the violation was reported.

- Sign the certification that the information provided is true and accurate, including your title and the date.

- After completing the form, save any changes made, then downloading, printing, or sharing the form as needed.

Complete your Form 211 online and submit your application for reimbursement.

Related links form

Report Suspected Tax Law Violations We will keep your identity confidential when you file a tax fraud report. You won't receive a status or progress update due to tax return confidentiality under IRC 6103.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.