Loading

Get Self Employed Income Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Employed Income Statement online

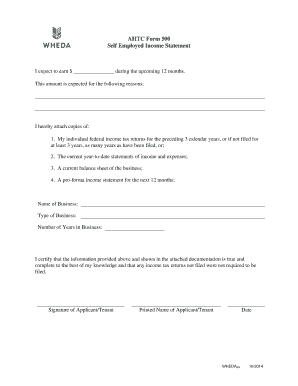

The Self Employed Income Statement is a critical document for individuals operating as self-employed, providing a snapshot of expected income and business health. This guide will walk you through the steps to efficiently complete this online form, ensuring that you include all necessary details for accurate representation of your financial status.

Follow the steps to fill out your Self Employed Income Statement online.

- Click ‘Get Form’ button to retrieve the Self Employed Income Statement and open it in your desired editor. This action will provide you with the necessary fields to complete.

- Begin by entering your expected income for the next 12 months in the designated space. Clearly articulate the sources for this income in the provided area.

- Attach copies of your individual federal income tax returns for the past three years, or for the number of years you have filed returns if it is less than three. If you have not filed any, state that appropriately.

- Provide your current year-to-date statements of income and expenses. Ensure these figures accurately reflect your business operations up to the present date.

- Include a current balance sheet of your business, outlining assets and liabilities to give a complete financial picture.

- Prepare and attach a pro-forma income statement outlining your expected income for the upcoming 12 months, reinforcing the anticipated figures submitted earlier.

- Fill in your business details, including the name, type, and number of years you have been in operation.

- Certify that the information provided is accurate, signing and dating the document as required.

- Review all the information you have input, ensuring accuracy and completeness. Once satisfied, you can save your changes easily.

- Final options allow you to download, print, or share your Self Employed Income Statement as needed.

Start completing your Self Employed Income Statement online today!

Related links form

An example In 2022 your net profit as reported on Schedule C is $35,000. Your net earnings subject to self-employment tax as calculated on Form SE would be $32,323 ($35,000 x 0.9235). Your self-employment tax would be $4,945 (32,323 x 0.153) and you would report that amount on Form 1040 in the "Other Taxes" section.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.