Loading

Get Dtf 727 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dtf 727 Form online

Filling out the Dtf 727 form accurately is essential for reporting your show information to the New York State Department of Taxation and Finance. This guide provides a detailed, step-by-step approach to help you through the online completion of the form with ease.

Follow the steps to complete the Dtf 727 Form online.

- Press the ‘Get Form’ button to obtain the form and access it in the online editor.

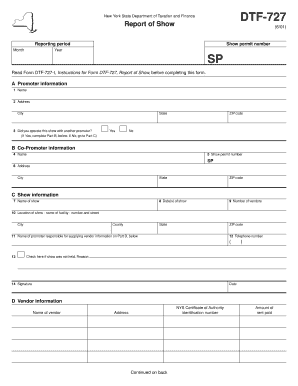

- Begin by completing the 'Promoter information' section. Enter your name in the first field, followed by your full address, including city, state, and ZIP code. Ensure all details are accurate.

- Indicate whether you operated the show with another promoter by selecting 'Yes' or 'No.' If you select 'Yes,' proceed to fill in Part B with the co-promoter's information.

- If applicable, fill out the 'Co-Promoter information' section. Include the co-promoter's name, their show permit number, and address with city, state, and ZIP code.

- In the 'Show information' section, provide the name of the show, the location of the show, and details of the promoter responsible for vendor information.

- Add the date(s) of the show and the total number of vendors that participated. If the show was not held, check the designated box and provide a reason.

- Sign and date the form in the 'Signature' section, confirming that all information supplied is accurate.

- Complete the 'Vendor information' section by filling out the name of each vendor, their New York State Certificate of Authority identification number, and their address. Include the total amount of rent paid.

- If additional vendor information is needed, utilize extra sheets as necessary. Ensure all data is complete before finalizing.

- After verifying all information, save your changes. You can then download, print, or share the completed form as required.

Complete your Dtf 727 Form online today and ensure your reporting is accurate and timely.

The list below has examples of taxable services in New York state: Prepaid phone calling service. Mobile telecommunication services. Telephone answering services. Utility services. Interior decorating and design service. Protective and detective services. Hotel occupancy. Admission charges to amusement parks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.