Loading

Get Tax Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Statement online

Filling out the Tax Statement online can streamline your tax submission process and ensure accuracy. This guide will walk you through the necessary steps to complete the Tax Statement, ensuring you provide all required information correctly.

Follow the steps to fill out your Tax Statement online effectively.

- Click the ‘Get Form’ button to obtain the Tax Statement form and open it in your preferred editor.

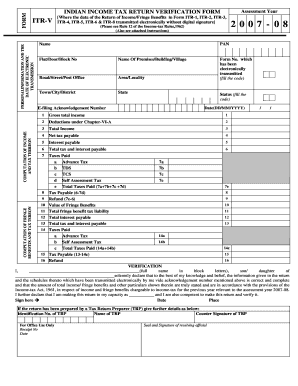

- Begin by entering your personal information in the designated fields, including your name, PAN (Permanent Account Number), and address details such as flat number, street name, town, and state.

- Fill in the assessment year for which you are filing the statement. This is crucial to ensure that your tax information aligns with the correct reporting period.

- Input the form number that corresponds to the ITR form you transmitted electronically. Use the accurate code for Forms ITR-1 to ITR-8.

- Enter the E-filing acknowledgment number and the date of electronic transmission. This information is typically provided by the Income-tax Department upon successful transmission.

- Provide details on your gross total income, deductions under Chapter-VI-A, and calculate your total income based on these figures.

- Calculate the net tax payable, adding any applicable interest and providing the total tax and interest payable in the designated fields.

- Detail the taxes paid, including advance tax, TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and self-assessment tax, ensuring all amounts are summed correctly.

- If applicable, calculate and enter any refund amounts that you expect to receive based on the payments made.

- In the verification section, enter your full name and any required identification details. Sign and date the document to confirm the accuracy of the information provided.

- Once all sections are completed, save your changes. You can then download, print, or share your completed Tax Statement.

Start filling out your Tax Statement online today for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form W-2, also known as a “Wage and Tax Statement,” reports an employee's income from the prior year and how much tax the employer withheld. Employers send employees a Form W-2 in January (a copy also goes to the IRS).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.