Loading

Get Kra Itaxgokepdf Filleronline Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Kra Itaxgokepdf Filleronline Form online

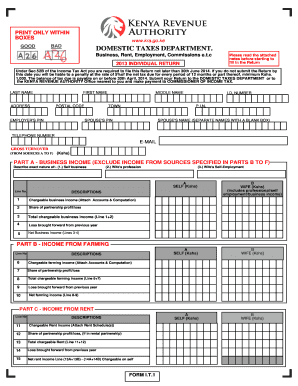

Filling out the Kra Itaxgokepdf Filleronline Form is a critical step for individuals to report their income correctly. This guide provides detailed steps to ensure that users can complete the form with confidence and precision, catering to all levels of familiarity with tax documentation.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the Kra Itaxgokepdf Filleronline Form and open it in your preferred online editor.

- Begin by filling in your personal information including your first name, last name, address, postal code, and identification details such as the I.D. number and Personal Identification Number (P.I.N). Ensure accuracy to avoid discrepancies.

- Provide your spouse's details, if applicable, by entering their P.I.N. and name. Use blank boxes to separate each name as specified.

- In the gross turnover section, enter the total income generated from all sources listed in the form from A to F.

- Proceed to Part A, where you will report business income. Describe the exact nature of your self-business, spouse's profession, and their self-employment, filling in the respective monetary fields.

- Continue to Part B for income from farming. Enter chargeable farming income and share of partnership profit or loss, and calculate the net farming income.

- In Part C, provide details on income from rent, including chargeable rent and share of partnership if relevant, plus the computation for net rent income.

- Part D is for interest income. Indicate any non-qualifying interest received and calculate total chargeable interest for both you and your spouse.

- In Part E, report income from insurance commissions, remembering to attach relevant accounts and computations required.

- Fill out other income not covered in previous parts in Part F, providing adequate details of the income's nature.

- Complete Part G by listing employment income for yourself and your spouse. Ensure to quantify gross pay, benefits received, and compute total employment income for both.

- Calculate total taxable income in Part H, factoring in deductions such as pension contributions and mortgage interest.

- Move on to Part I, where you will compute the tax payable for both yourself and your spouse, applying personal reliefs where applicable.

- In Part J, determine total taxes including any penalties or interest that may apply if there are delays.

- Part K requires you to detail payments, penalties, and interests related to your tax obligations, clearly identifying any amounts due.

- In Part L, list any self-employment or directorship details, ensuring to include employer P.I.Ns and gross remuneration where necessary.

- Part M involves noting any partnerships you or your spouse may have been involved in, providing relevant financial details.

- Provide landlord details in Part N if applicable, including their name, address, and amount of rent paid.

- Finally, make the declaration in Part P, ensuring to sign and provide bank details for possible refunds. Review all entries for accuracy before submission.

- Once all sections are filled, users can save changes, download a copy for their records, print the completed form, and share it as necessary.

Complete your documents online today for a smooth filing experience!

What is the requirement for one to obtain a KRA PIN? What should I do if I forget my password? Go to the iTax log in page and click on forgot password link, answer the security stamp arithmetic and new log in credentials will be sent to your registered email address.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.