Loading

Get Form 126

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 126 online

Filling out Form 126 online can be a straightforward process if you follow these detailed steps. This guide will provide you with the necessary instructions to complete the Board of Zoning Adjustment Fee Calculator accurately.

Follow the steps to successfully complete Form 126 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

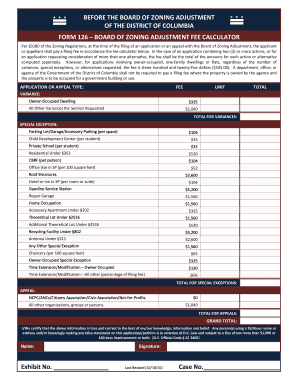

- Carefully read the 'Application or Appeal Type' section. Here, you will select the type of application or appeal you are submitting. Review the fee schedule associated with each type to ensure you understand any costs involved.

- In the next fields, accurately input the totals for each category (variance, special exception, appeal). Be sure to calculate any additional fees required depending on the specifics of your application.

- Confirm that the 'Total for Variances', 'Total for Special Exceptions', and 'Total for Appeals' sections reflect the correct amounts based on the information you have entered.

- At the end of the form, review the certification statement to ensure that all information provided is true and correct to the best of your knowledge, understanding the implications of any misrepresentation.

- Once you have completed the form, you can save changes, download the document, print it for your records, or share it as needed.

Start completing your Form 126 online today to ensure timely processing of your application or appeal.

Related links form

The state use tax rate is 4.225%. Cities and counties may impose an additional local use tax. The amount of use tax due on a transaction depends on the combined (local and state) use tax rate in effect at the Missouri location where the tangible personal property is stored, used or consumed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.